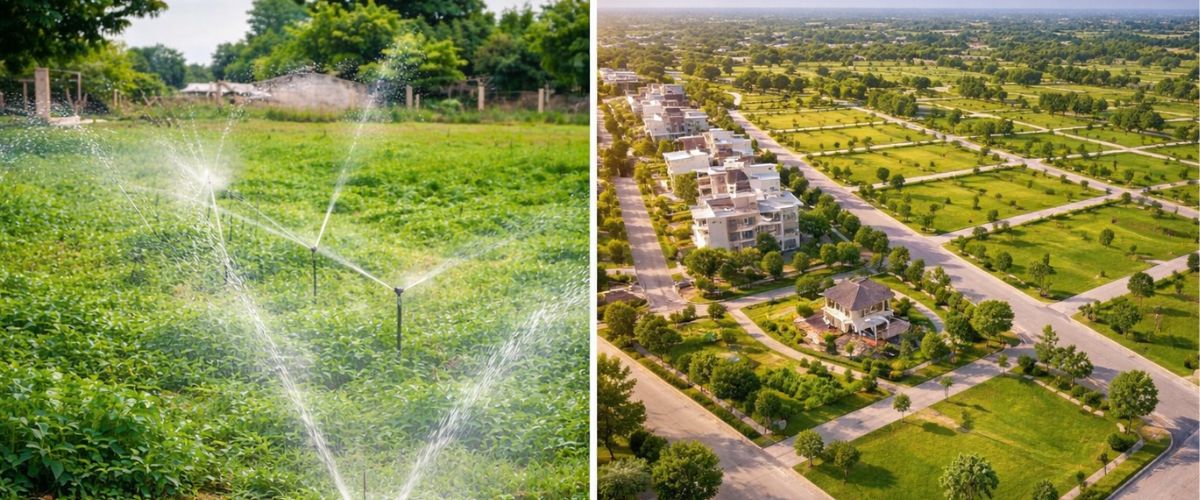

The comparison between agricultural land and residential plots in India as an investment option has always been a common topic. In recent years, with the changing market trends along with an increase in the level of demand for infrastructure and also the different purchasing behaviours of Investors, many NEW investors have asked the question, "Should I invest my money into either Agricultural Land or Residential Plots?" Each Asset class has its advantages, disadvantages, and potential for long term growth potential. Therefore it is critical to understand the differences between the two asset types, together with a comprehensive understanding of their potential for growth, before making an investment decision.

Among the various options gaining attention today is managed farmland near Bangalore investment, which has emerged as a practical way for urban investors to access agricultural land without handling daily operations themselves. At the same time, traditional agricultural land continues to attract buyers looking for affordability and long-term appreciation, while residential plots remain popular for their liquidity and development potential.

Agricultural Land is defined as land which is predominantly used for farming, horticulture and other types of Agricultural related activities. Historically, Agricultural Land was viewed as a low-cost investment for the long-term. However, with the increasing depletion of Stock and a growing interest in sustainable living, there has been renewed interest in Agricultural Land as an investment option.

Low Entry Cost

Agricultural Land typically has a much lower price per acre or per square yard than the equivalent Residential Land price; therefore it is a very attractive offer to the NEW Investor who wants to get involved in Real Estate.

Generally, investing in agricultural land can provide long-term gains due to the increasing popularity of organic farming and sustainable lifestyles. However, investors should be aware of the challenges they may encounter when purchasing agricultural land.

Long-Term Growth Potential

Agricultural land located near growing urban centers or areas of development (e.g. highways, industrial corridors, airports) has the potential for greater appreciation over time, especially if the property is eventually converted for a different use.

Tax Incentives

Agricultural income is not taxed under Indian taxation law. Agricultural land in a number of states may also qualify for maximum exemptions from capital gains tax depending on its location and intended purpose.

Sustainable Living & Lifestyle Appeal

With the continued interest in the environment, eco-friendly farming practices and farm-to-table relationships, agricultural land is becoming increasingly valued as an investment and lifestyle asset.

There are challenges associated with investing in agricultural land including:

Residential plots are land parcels approved for residential construction and governed by development authority norms. These plots are often located within planned townships, gated developments, or urban extensions.

1. Clear Legal Status & Usage

Residential plots come with clearly defined land use, approved layouts, and proper zoning, reducing legal complexities for buyers.

2. Higher Liquidity

Residential plots are easier to sell due to strong demand from end-users, homebuilders, and investors alike. This makes them a more liquid asset.

3. Faster Appreciation in Growth Corridors

Plots located near infrastructure projects such as expressways, metro lines, IT hubs, and international airports often witness rapid price appreciation.

4. Construction & Rental Potential

Residential plots allow investors to construct homes, villas, or rental properties, creating opportunities for both capital appreciation and steady rental income.

Higher Acquisition Cost: Residential plots usually require a higher initial investment compared to agricultural land.

Taxes & Development Charges: Buyers may need to pay GST, development fees, and property taxes.

Market Sensitivity: Residential plot prices can be influenced by short-term market fluctuations.

Market Sensitivity: Residential plot prices can be influenced by short-term market fluctuations.

| Aspect | Agricultural Land | Residential Plots |

| Entry Cost | Lower | Higher |

| Appreciation | Long-term | Medium to fast |

| Legal Complexity | Higher | Lower |

| Liquidity | Low to medium | High |

| Rental Income | Limited | High |

| Tax Benefits | More favorable | Standard taxation |

| Ideal For | Long-term investors | End-users & active investors |

The right choice depends on your investment horizon, risk appetite, and financial objectives.

You want faster returns and higher liquidity

Whether agricultural land or residential plots, location remains the most critical factor. Areas near upcoming airports, expressways, industrial zones, and urban expansions often outperform others. Projects located in growth corridors like Jewar, Noida Extension, Yamuna Expressway, and emerging peripheral zones have demonstrated strong investment performance in recent years.